A little under a year ago, I wrote a Tweetstorm titled Venture Capital Isn’t Built For Outsiders. It was a long, maybe 30 or 40 tweets in length, outlining the competing incentives of early-stage venture capitalists and founders. After writing it, I got an unexpected response. Over 500 people liked the post, hundreds commented in agreement, and I even got retweets as endorsements from the likes of Elizabeth Yin and Mac Conwell. I knew I had struck a chord. Little did I know then that two months later, I would be quitting my job at a venture-backed YC company to solve this very complicated problem. It’s been 10 months since then…and I am very excited to present the culmination of all my hard work since leaving that job; Introducing Seedscout!

What is Seedscout?

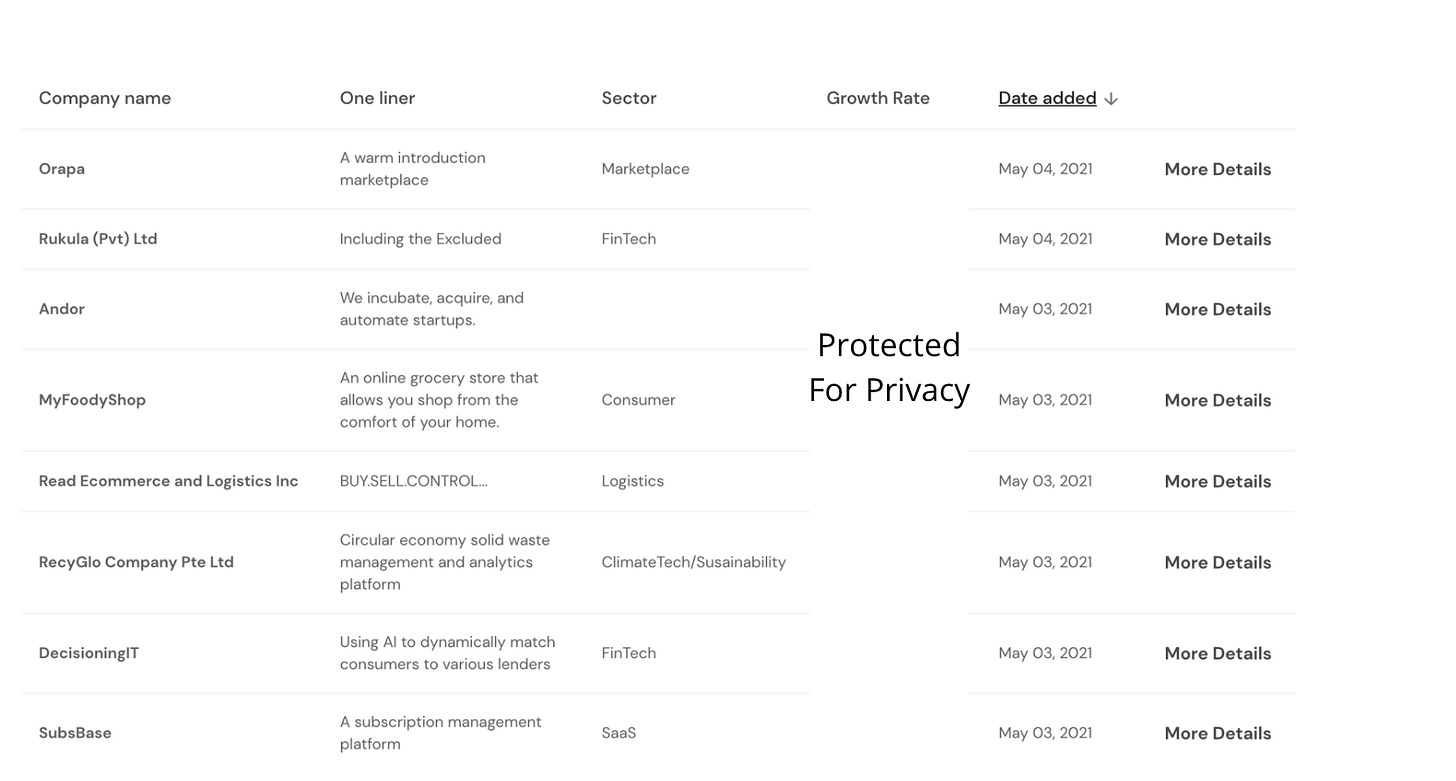

Seedscout connects pre-seed startups to investors looking to work with them. We have a growing group of scouts who go out into the world and find companies they believe will win, and then scout them. To scout a company, the scout collects different information that would help an investor understand the investment opportunity. We collect revenue data, product development progress, social links, and more. We have a dashboard that we built for our customers that allows them to sift through every scouted company.

If you’re interested in diving into any of the companies, all you need to do is click

”more details”. That then unlocks a profile view. Here, we show a few types of data.

The Basics

Sometimes, the hardest info to collect is the most simple. We’ll make sure we have your bases covered with the one-liner, sector, URL, and growth rate.

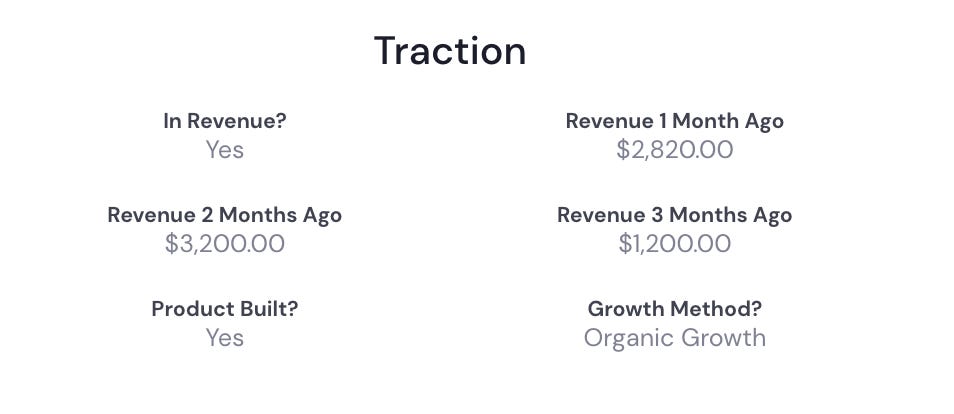

Traction

Of course, every investor wants to know the traction of a startup so they can filter them effectively. We collect traction data around revenue and product to help you truly determine the stage of the company.

Competition

It’s helpful to understand how the founder thinks about competition. If they list Facebook and Google, you know they may not be thinking critically enough. If they list no one, that tells you all you need. But if they list a few real competitors, it allows you to do some quick research without assuming anything.

Fundraise Details

If a startup has $20,000 MRR, it’s easy to be impressed. Yet, if they raised $3M to get to that number, it’s a lot less impressive. We collect historical fundraising information as well as current round details so you can properly size up a deal. Of course, we also make viewing the deck and even requesting an intro simple as clicking a button.

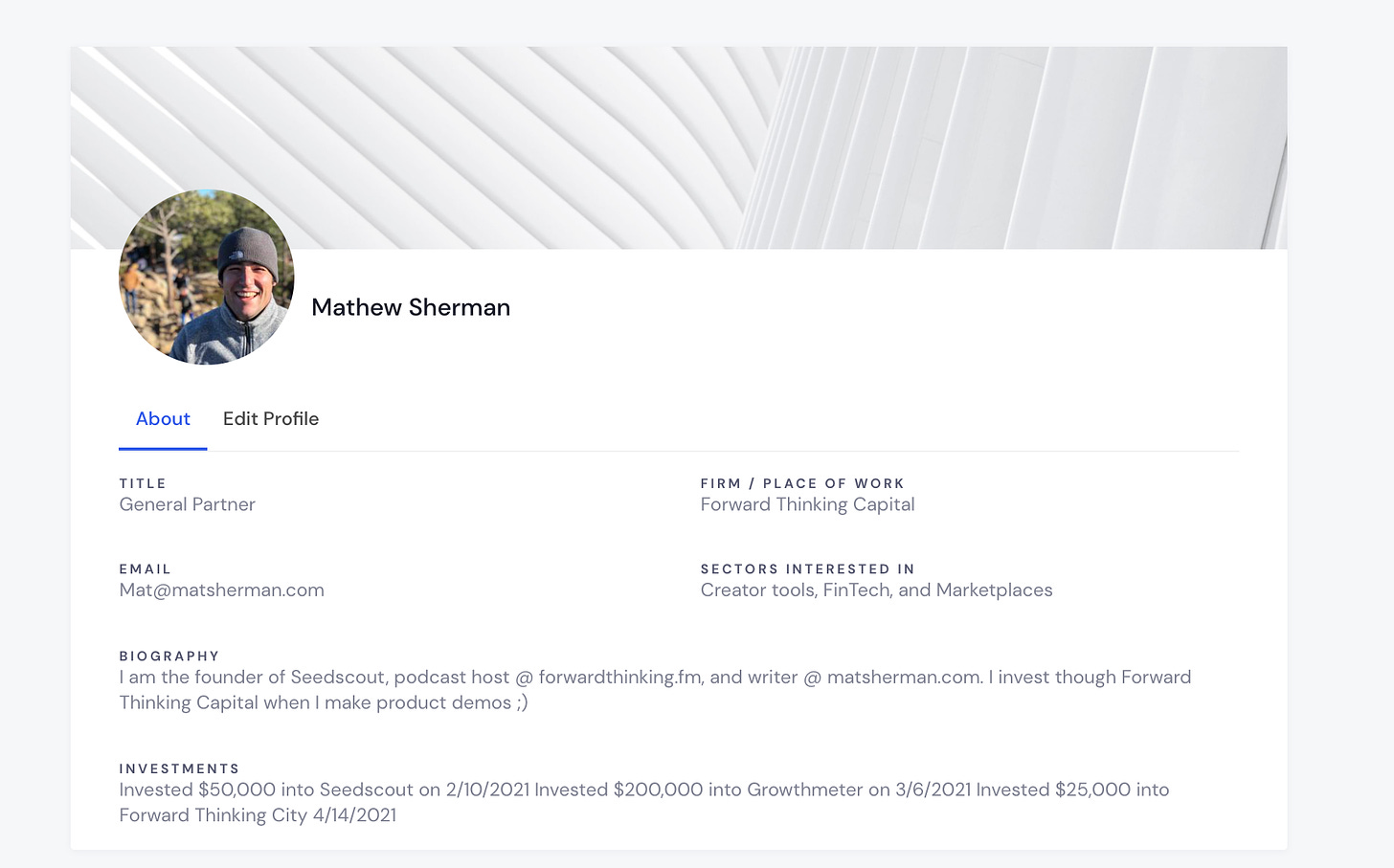

Your Profile

When you request an introduction, we immediately send the founder your information to accept or deny the intro request. Here is the info you can edit about yourself that founders see.

More of a Visual Learner? Here’s a Video Demo!

How Much Does It Cost?

Right now, the price point is $1,000/mo. Considering we are doing the job of an analyst, which costs $50,000/yr +, we consider the $1,000 price point very fair. With that said, if you are a newer fund or an angel investor and can’t swing the $1,000/mo, respond to this email and let me know what works best for you.

Are you sold? Want to try out Seedscout for a month or two? You can book a demo below. Note that if you aren’t satisfied as a customer, we’ll refund your first month.

I am very excited to start spreading the word about Seedscout. We have thought very carefully about how to build this product in a way that truly changes the fact that venture capital is not built for outsiders. With your help (by becoming a customer), we’ll be able to change the course of history and help create a more efficient private investing market. To the moon!